The price and loan terms most people are willing to accept is getting ridiculous. In this article I provide five simple rules for car buying.

The average purchase price for a new vehicle is almost $39,000 with an average loan amount of $32,480 or 83% (source: Experian) of the purchase price. What are people thinking? To put that into perspective, the monthly payment in this scenario would be over $600. Total interest cost would be almost $5,000 and the total cost including interest expense would be over $37,000!

The Facts about Car Buying

- The overall American automobile debt pool as of December 2019 was $1.2 trillion.

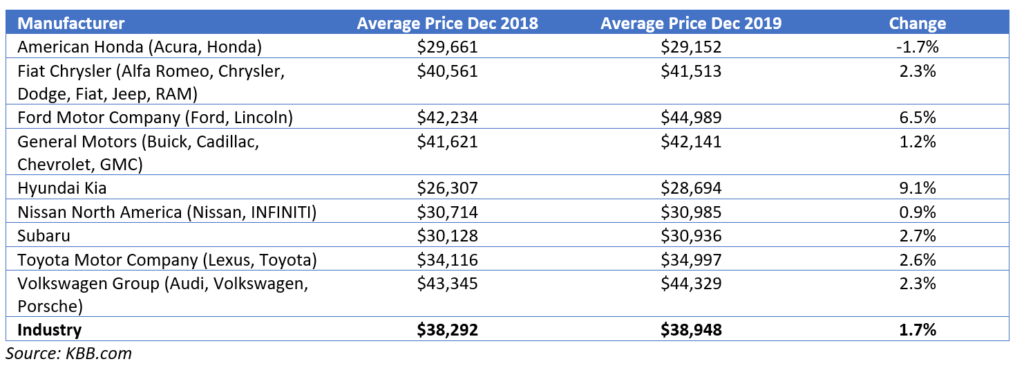

- The average transaction price for a new vehicle in America as of December 2019 was $38,948, up almost 2% from the previous year.

- The average loan amount for a new vehicle is $32,480 and $20,446 for a used vehicle.

- The average automobile loan interest rate is 5.61% for a new car and 9.65% for a used car as of March 31, 2020.

- The average monthly car payment in the US is $550 for new vehicles and $393 for used.

- The average loan term is 69 months for a new car and 35 months for a used car.

The table below provides some interesting numbers on purchase price by vehicle manufacturer.

Five Simple Rules

1 – Think like a millionaire and do not use a loan to buy a vehicle. In his book, Everyday Millionaires, Chris Hogan found that eight out of ten millionaires do not have car payments. Before you scoff, think differently. Millionaires did not become millionaires by paying interest. Take the $600 average monthly car payment and invest in a low fee S&P 500 index fund. After two years you will have over $15,000 saved which is more than enough to purchase a reasonable used car.

2 – Follow the 40 / 10 Rule. If you really think you need a car loan, follow the 40 /10 rule. The total amount financed should never be greater than 40% of the total vehicle cost and 10% of your gross annual income. This means that if you really want to by a shiny new car at the average purchase price of almost $39,000 you can only finance around $15,500 and you must be earning over $150,000 annually. Hopefully, this rule is harsh enough to make you think hard before taking on more debt.

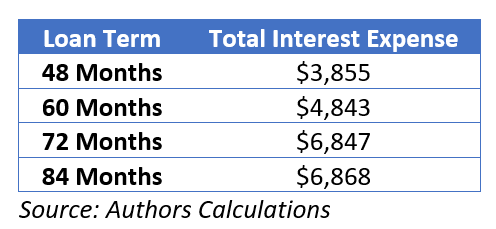

3 – Do not extent loan terms beyond 48 months. Resist the urge to extend the loan term to 60, 72 or even 84 months to get a lower monthly payment. The longer the loan term, the more interest you pay, and the less your vehicle is worth. Using the example above of an average loan amount of $32,489 and interest rate of 5.61%, the difference in total interest cost between 48 months and 84 months is over $3,000. During the loan term your vehicle will depreciate 10-15% each year and may be worth less than 60% of the purchase price by year 5 and less than 80% by year 7. The table below illustrates the total interest cost using 48-, 60-, 72- and 84-month terms. Remember, even at 48 months, $3,855 is a lot of interest!

4 – Do not rollover an existing loan. The math is simple and there is no upside. Several years ago, while researching vehicles I overheard a salesman convincing a young man he could rollover his existing $10,000 loan, lower his monthly payment and drive home in a new truck that day. The young man was bamboozled! If you purchase a vehicle at the average price of $39,000 with an average loan amount of $32,480 and you roll over an existing $10,000 loan, your new loan amount of $42,480. The only way to get a lower payment is to extend the loan term. See rule number 3 above. There is no upside.

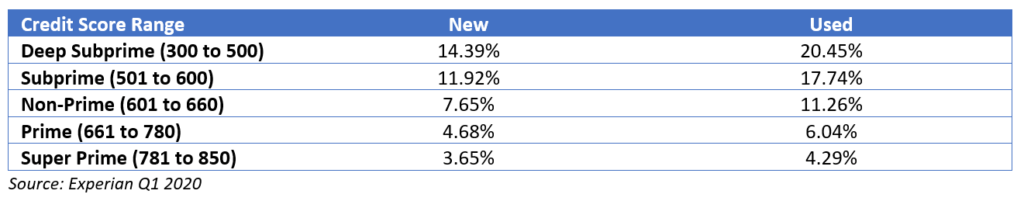

5 – Maintain a healthy credit score and get the best interest rates. Automobile loan interest rates range from around 3% with an excellent credit score to over 14% with a poor credit score. The table below illustrates the average new and used car interest rates by credit score range.

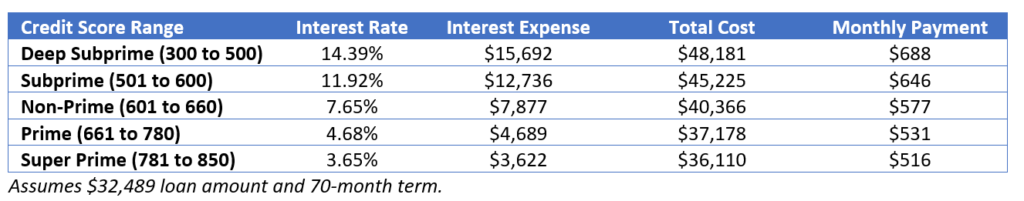

The total cost of a $32,489 loan at 14.39% is over $48,000 with a monthly payment approaching $700. The total cost of the same loan at 3.65% is 36,110 and a savings of almost $12,000. The bad credit penalty is over $12,000! According to Experian, the average new car interest rate is closer to 5.6% so $32,489 at 5.61% is around $38,000 with interest expense of over $5,000. Staying on top of your finances and maintaining a healthy, above average credit score really pays off. The chart below illustrates the interest expense and total cost of the average car loan at each interest rate range.

Hopefully, this article has given you a few things to think about before purchasing a vehicle. Instead of purchasing a new $39,000 vehicle and financing $32,489, start investing the monthly payment amount into a low-cost S&P 500 index fund and grow your wealth over time.

Dale