This is the first in a multi-part series on how to become a millionaire. In this article I analyze the personal finance habits and demographics of millionaires in America and give you a to-do list for taking immediate action. For this article I am defining millionaire as households with a $1,000,000 net worth not including primary residence.

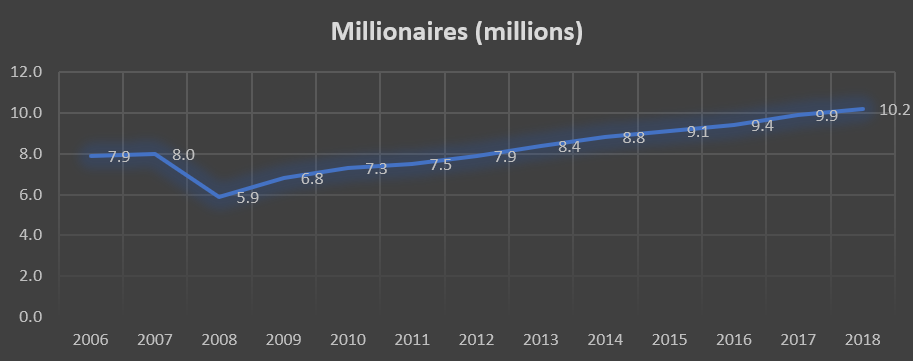

Millionaires are on the rise. There are more millionaires this year than last and the number of households with a net worth of $1,000,000 or more has steadily increased since dipping after the 2008 great recession. The chart below illustrates the change in millionaire count over time.

Millionaires Have a Net Worth Mindset

Millionaires focus on Net Worth, not income alone. Net worth is a concept which focuses on the difference between your assets (the stuff you own) and your liabilities (the debt you owe). If your liabilities increase at the same level as your assets you have not really accomplished anything. If your liabilities increase at a greater rate than your assets you are headed for financial disaster.

“From the time we are old enough to understand, society conditions us to confuse income with wealth. We believe that doctors, CEOs, professional athletes, and movie actors are rich because they earn high incomes. We judge the economic success of our friends, relatives, and colleagues at work by how much money they earn. Six- and seven-figure salaries are regarded as status symbols of wealth…If you earn a million in a year and spend it all, you add nothing to your wealth. You’re just living lavishly…It’s not how much you make; it’s how much you keep.” – John C. Bogle

In the late 1990s Nicolas Cage was at the height of stardom. He had just co-starred with Sean Connery in The Rock and was reportedly bringing in around $20,000,000 a film. Cage reportedly purchased 15 homes, a gulf stream jet, four yachts, a small squadron of Roll Royce vehicles, millions in art and of course two castles in England and Germany. Other more unique purchases included shrunken pygmy heads, a Lamborghini, a pet octopus, a deserted island in the Bahamas and a dinosaur skull. Add to that Cage’s entourage and extravagant parties and vacations and you have a recipe for financial disaster.

According to his former business manager, Cage would scoff or flat out ignore advice to save or invest money and would regularly squander tens of millions of dollars a year. Eventually Cage hit rock bottom and in 2010 he described his financial situation as “catastrophic.” He was forced to sell his homes in California, Las Vegas, New Orleans, and even his prized Somerset castle, which is built in the shape of the ace of clubs. At one point the IRS filed liens against Cage totaling around $18 million for unpaid taxes.

Cage and many other high-income earners suffer from what I call the paycheck mentality. Those suffering from the paycheck mentality focus on making and spending money in the short-term. Income is a means to purchase stuff, elevate social status and provide a short-term high. The paycheck mentality just like the paycheck itself is inherently short-term. The high from purchases fades quickly leading to a vicious cycle of depression and lavish spending.

Earning a higher income is not a requirement for achieving wealth. Let that sink in for a minute. You do not have to make a lot of money to build wealth and achieve financial independence. Earning a lot of money certainly helps build wealth but it is not a requirement and not everyone who earns a lot of money is wealthy.

To build wealth and achieve financial independence you must banish the paycheck mentality and adopt what I call the Net Worth Mindset.

Millionaires Automate Their Success

Millionaires automate their success. In his book Automatic Millionaire, David Bach shares the example of Jim and Sue McIntyre who at only 52 were able to retire comfortably with a $2,000,000 net worth. Their secret was simply to avoid debt and pay themselves first by implementing a system of automated transfers and investments.

I read the Automatic Millionaire in my early twenties and immediately implemented bi-weekly transfers to savings and investments. Over time the amount has changed, some years more and some less, but I have always had an automated system in some form. Currently I have the following automated transfers.

- Automatic transfer to a health savings account. We manage our healthcare by always having a few thousand dollars on hand for preventative visit and minor medical emergencies.

- Automatic transfer to retirement savings (401k, IRA, etc.). Aim to contribute enough to take full advantage of employer contribution matching.

- Automatic transfer to cash savings. Emergency fund, general saving for major purchases, saving for insurance premiums, etc.

- Automatic transfer to college savings 529 accounts. Set up college savings funds while your kids are babies. Giving your kids a chance to have more choices and opportunities than you did is an amazing feeling.

- Automatic transfer to brokerage account for dollar cost averaging investments. Build up a sizable after-tax investment portfolio in case you want to retire before you are able to safely access your retirement funds.

Millionaires Practice Stealth Wealth

Millionaires practice stealth wealth. In his article, The Rise of Stealth Wealth: Ways to Stay Invisible from Society if You Have Money, Sam at Financial Samurai shares a handful of rules millionaires follow for staying grounded and living under the radar.

- Never share your true income with anyone. Only those who are insecure or who want to sell you something will reveal their true income. Those who brag about wealth are either lying or seeking social status. This behavior will ensure one is not wealthy for long.

- Incorporate, diversify and protect assets. Millionaires may have a series of legal structures set up to protect assets and provide tax benefits. Limited Liabilities Corporations, Charitable Foundations and trusts allow you to spread out your assets across multiple entities and take advantage of tax benefits.

- Pretend you do not understand. Millionaires are smart but they guard their intelligence. You cannot learn if you think you already know everything, and no one wants to be around a know-it -all!

- Praise Others. Millionaires take advantage of every opportunity to build others up and praise success. Only insecure people seek to tear others down and boast. Energy spent degrading others is better spend on self-improvement, building relationships, seeking out new opportunities and growing wealth.

- Stay Humble and Be Grateful. Millionaires always attribute a portion of their success to luck. The easiest way to alienate others and damage relationships is to make known your exceptional skills and hard work. Attributing your success to luck makes you come across as a decent human and will likely reduce the number of requests for money and advice.

Millionaires Avoid Debt

Millionaires do not have car payments. In his book, Everyday Millionaires, Chris Hogan found that eight out of ten millionaires do not have car payments. Before you scoff, think differently. Millionaires did not become millionaires by paying interest.

Millionaire Professions

Millionaires are educated and hold positions of influence in major industries. In their study, What Jobs Turn out Millionaires, The Spectrem Group found that millionaires are most likely to describe their profession as Management, Professional Services (doctor, lawyer, etc.), Education, Information Technology and Healthcare.

Investing Habits of Millionaires

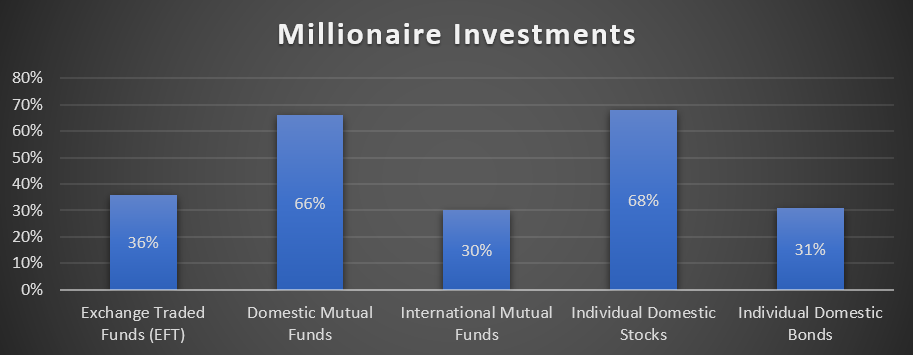

Millionaires earn equity compensation and invest in individual growth stocks. The chart below shows that millionaires are most likely to invest in individual stocks and mutual funds with some exposure to exchange traded funds, international funds and bonds.

High investments in individual stocks are likely a result of earning performance incentives in the form of company stock shares and investments in individual growth stocks such as Tesla or Amazon. For example, a $10,000 investment in Tesla stock at 30.21 dollars a share on February 12, 2016 would now be worth over $266,000 dollars. “Diversification may preserve wealth, but concentration builds wealth.” – Warren Buffet

Millionaire Demographics

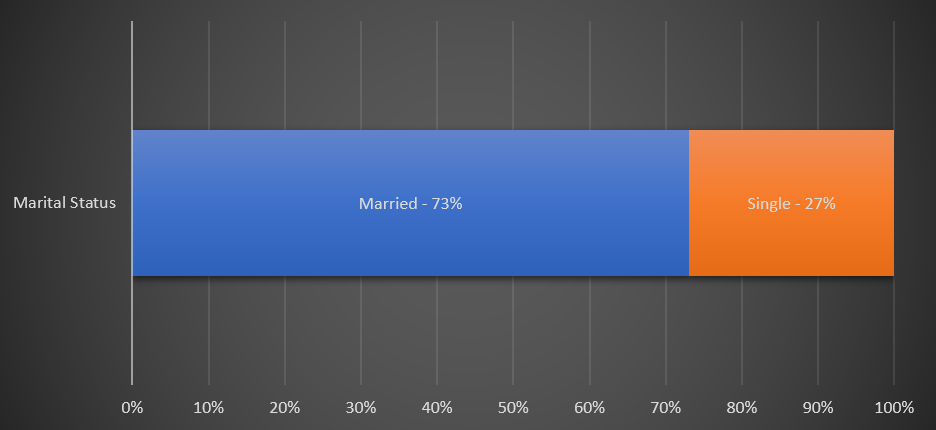

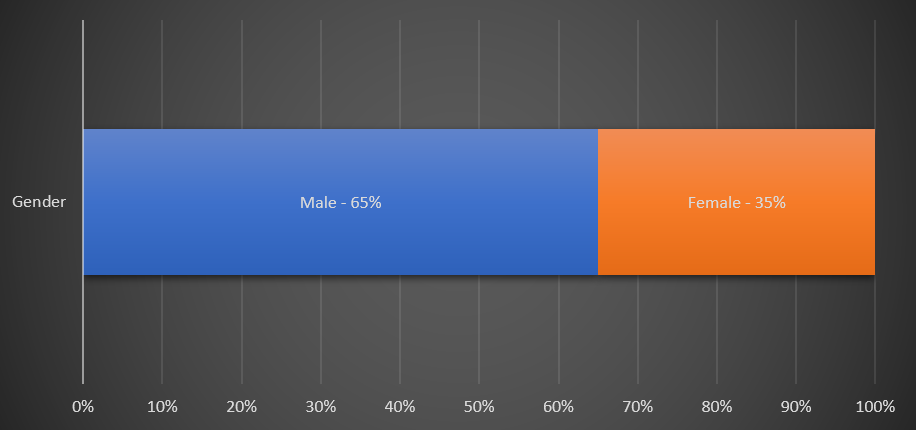

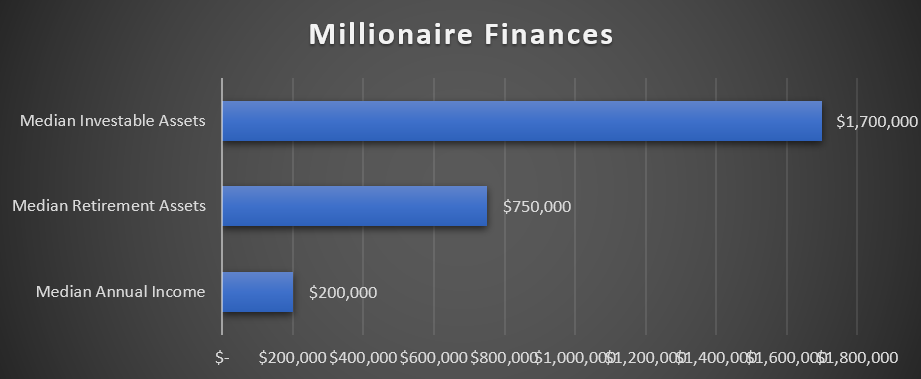

Millionaires are most likely to be married men who earn at least $200,000 annually. Gender pay inequality likely plays a role in this. In their recently published study, The Gender Pay Gap Among Top Business Executives, the National Bureau of Economic Research (NBER) found that unconditionally, women earn 26% less than men amongst top executives. As corporate culture evolves the ratio of male to female will even out.

Millionaires generally have short-term liquid assets (cash, stock, etc.) of at least $1,700,000 and retirement assets of $750,000.

Spending Habits of Millionaires

Millionaires spend their money just like you would think. They are likely to spend $10,000 or more annually on vacations, travel, home improvement projects and automobiles. They are likely to spend up to $4,999 annually on clothing, entertainment and charitable contributions.

The Millionaire To-Do List

- Adopt a Net Worth Mindset.

- Set up automatic saving and investment transfers and start paying yourself.

- Avoid debt like COVID-19.

- Seek out employment in a high paying industry or one with a strong culture of gender pay equality.

- Practice Stealth Wealth.

- Invest, diversify and take educated risks.

Sources

The Spectrem Group, How do Millionaires Spend Their Money?, Retrieved December 2020

The Spectrem Group, The History of Millionaire Market Numbers, Retrieved December 2020

National Bureau of Economic Research, The Gender Gap Among Top Business Executives, Retrieved February 2021

Fidelity, The 2018 Fidelity Millionaire Outlook Study, Retrieved December 2020