In this article I attempt to simplify the complex world of credit scores and interest rates and provide simple actions for maintaining and improving your credit score. Check out my article A Simple Guide to Understanding Credit Bureaus for information on how to obtain a free copy of your credit report.

What is a credit score?

Credit scores are simply a numeric indicator of risk. The credit reporting companies collect credit history data on millions of consumers and use the data to build credit score models. Statisticians analyze the data and tease out which consumer behaviors and attributes are the best predictors of loan defaults.

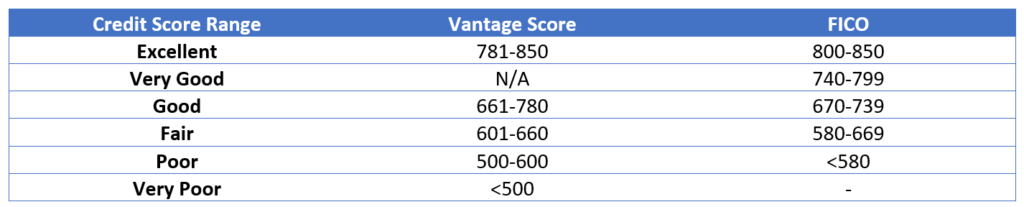

Credit score ranges vary but are generally grouped into categories ranging from very poor to very good. The table below illustrates credit score ranges from two of the most well-known credit scores.

How are do credit scores impact interest rates?

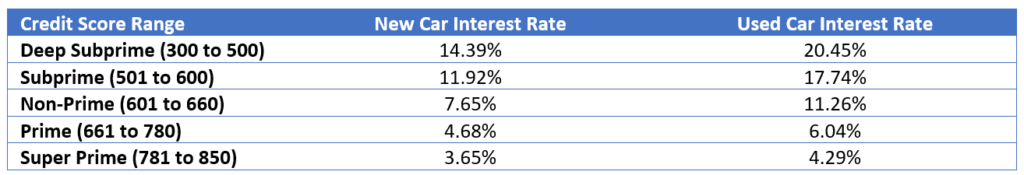

Lenders use credit scores as one of several tools to determine how much money to lend and at what interest rate. Consumers with lower credit scores are higher risk and may be charged higher interest rates. Consumers with higher scores are lower risk and may be charged lower interest rates. The table below was sourced from Experian and illustrates the risk-based pricing for automobile loans as of Q1 2020.

The penalty for having a low credit score can be steep. In my article Five Simple Rules for Car Buying, I share an example illustrating the interest rate and total interest expense for each credit score range. The low credit score penalty can be up to $12,000 for a new vehicle. Yikes!

Credit scores can also be used by credit card companies to identify new prospects and potential credit limit increases for existing customers.

Why are there so many different credit scores?

Credit scores are specific to the underlying credit history data and the credit score methodology used. Hold on, this is where things start to get confusing.

- Not all lenders report credit history data to all three of the major credit reporting companies.

- Not all lenders pull credit reports and scores from the same credit reporting company.

- Credit reporting companies may license a third-party credit score methodology such as FICO and apply the methodology to their proprietary databases.

- Credit reporting companies may also have their own proprietary credit score methodology.

- Almost all credit scores are version controlled and may change over time.

- Not all lenders use the same version of the same credit score. One lender may use version credit score version 1 while others may use credit score version 2.

The exact number of credit scores is a mystery. We know of at least 50 and maybe up to 100 or more. FICO markets almost 50 different credit score models covering most transactions. The most recognizable types are the Generic FICO Score, FICO Mortgage Score, FICO Auto Score, FICO Bankcard Score, FICO Installment Loan Score and FICO Personal Finance Score. Each FICO model is version controlled and not all financial institutions use the same version. So, there could be hundreds of different credit scores in play on any given day.

What factors impact my credit score?

The generic FICO score considers the following:

Credit Type and Payment History – 35%

Payment history on credit accounts such as mortgage loans, automobiles loans, credit cards and others are the most important factors. This includes late payments, bankruptcies, judgments and liens. FICO also looks at the severity of delinquency (30 days, 60 days, 90 days etc.), the outstanding balance on delinquent accounts, the length of time passed since delinquency and the ratio of delinquent accounts to total accounts in the history.

Total Debt and Utilization – 30%

Credit utilization is the amount you owe divided by the total amount of available credit. For revolving credits, utilization is a good indicator of future problems. Someone who consistently takes on debt and maxes out credit cards is generally riskier than someone with a low history of debt usage. FICO score looks at the total amount owed on all accounts, how many accounts are currently being used and the credit card balance to available credit ratio.

Length of Credit History – 15%

A longer credit history is generally better. The FICO score looks at the length of time your credit accounts have been established including the age of the oldest, newest and average of all credit accounts.

Credit Mix – 10%

FICO scores look at the different types of credit accounts and your ability to manage different types of loan obligations.

New Credit – 10%

FICO looks at the number and frequency of new accounts opened in the past year. A high number of new accounts opened in a short amount of time could indicate financial stress and represent higher risk. Also considered is the amount of time since you opened your last new account. Rate shopping and inquiries for promotions, insurance and employment are generally excluded from this category.

How do I improve my credit score?

- Establish a pattern of paying on time. A few late payments do not mean an automatic credit score death sentence. If you are behind on payments get caught up and stay caught up.

- Pay down credit balances. Make a plan to reducing debt levels. Check out How to get out of debt: 10 strategies that work.

- Check your credit reports for errors and dispute inaccuracies with your creditors and the three major credit reporting companies. Visit AnnualCreditReport.com for information on obtaining a free credit report and disputing inaccuracies.

- Do not fall for quick fix schemes. Most rapid credit score improvement schemes are fraud and can carry criminal and or civil penalties.