Several years ago I attended a conference at which the Chief Economist of a major financial services firm predicted the U.S. economy would enter into a recession by April 2020. My initial excitement over the bold prediction quickly faded when we were all invited to subscribe to a monthly service for ongoing updates. Anyone making specific claims about a recession is probably trying to sell you something.

Will the economy enter into a recession in April 2020? Maybe, but I don’t think that is the right question to be asking. It seems like better questions could be:

- What is a recession?

- How will a recession impact me?

- What can I do to prepare for a recession?

- How can I profit from a recession?

In this post I’ll take you through the basics of recessions and provide some common sense tips to fortify your finances just in case the April 2020 prediction comes true.

What is a Recession?

Recessions are almost as difficult to define as they are to predict. The National Bureau of Economic Research (NBER) is the resident expert on recessions and is tasked with owning the definition of a recession and making the official call on when a recession starts and ends.

Recession: A decrease in Gross Domestic Product (GDP) for two consecutive quarters.

Significant declines in manufacturing and increases in unemployment typically accompany a decrease in GDP.

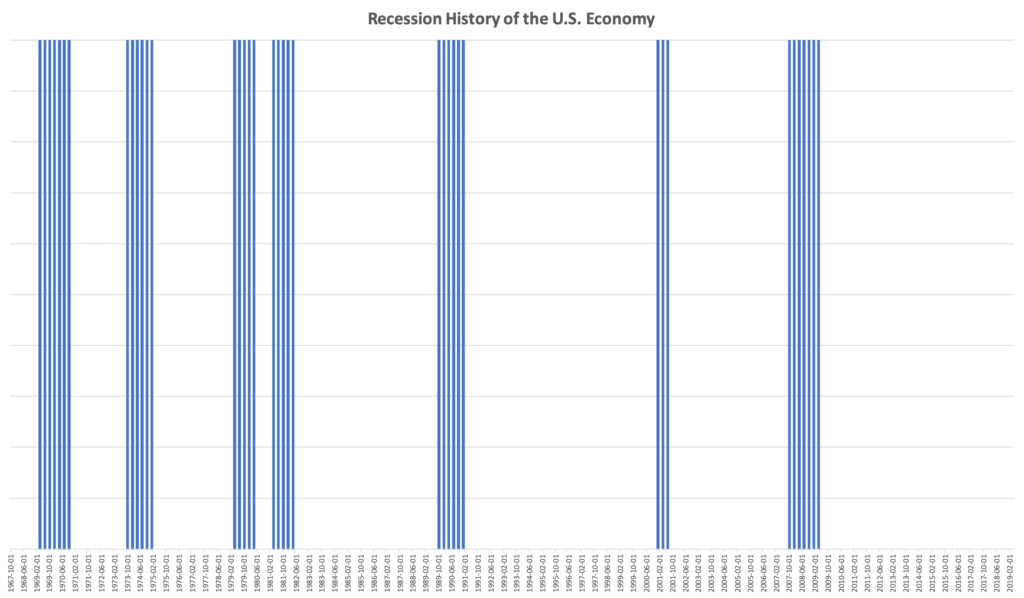

The chart below shows the frequency and duration of every recession in the U.S. Economy going back to 1967. As you can see, the average recession has historically lasted around 10 months and at present we are experiencing one of the longest periods of sustained economic growth in U.S. Economic history.

What Causes a Recession?

Recessions typically result from unanticipated shocks to the economy due to:

- Too much debt. Overly optimistic projections combined with lax credit and lending standards lead to business and consumers taking on too much and or poorly structured debt.

- Geopolitical issues. Poor or failed foreign policy, wars, trade wars, failed government action negatively impact prices, free trade and confidence.

- Rapid Change. Rapid industry or technology changes lead to obsolesces and rising prices.

- Psychology. Thinking becomes reality. Self-fulfilling prophesies of pessimism, doom and gloom.

- Not enough money. Contraction of the money supply. Availability of credit does not align with industry or sector growth. Not enough money to fuel continued growth.

How Will a Recession Impact Me?

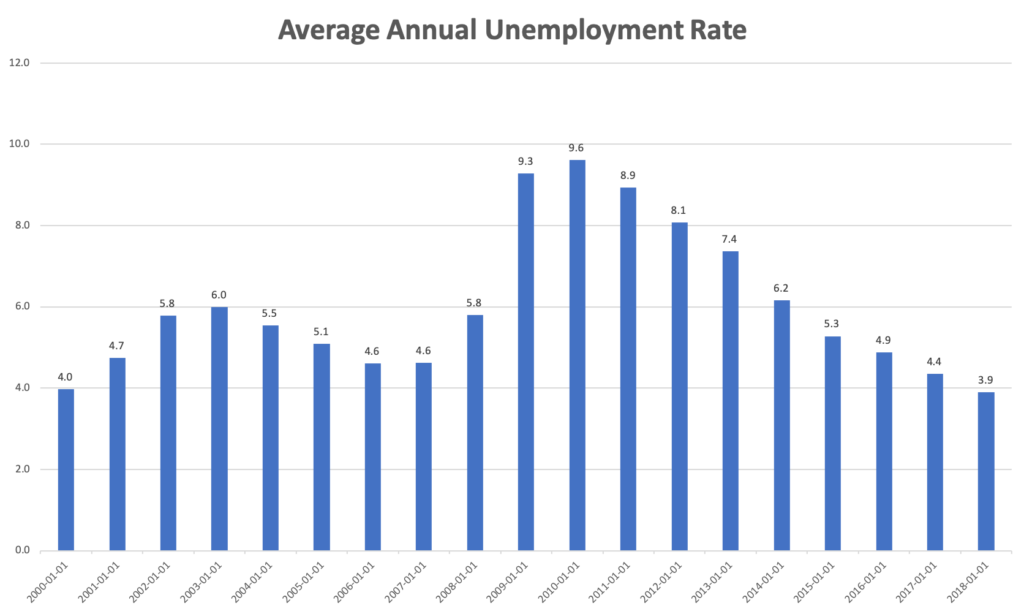

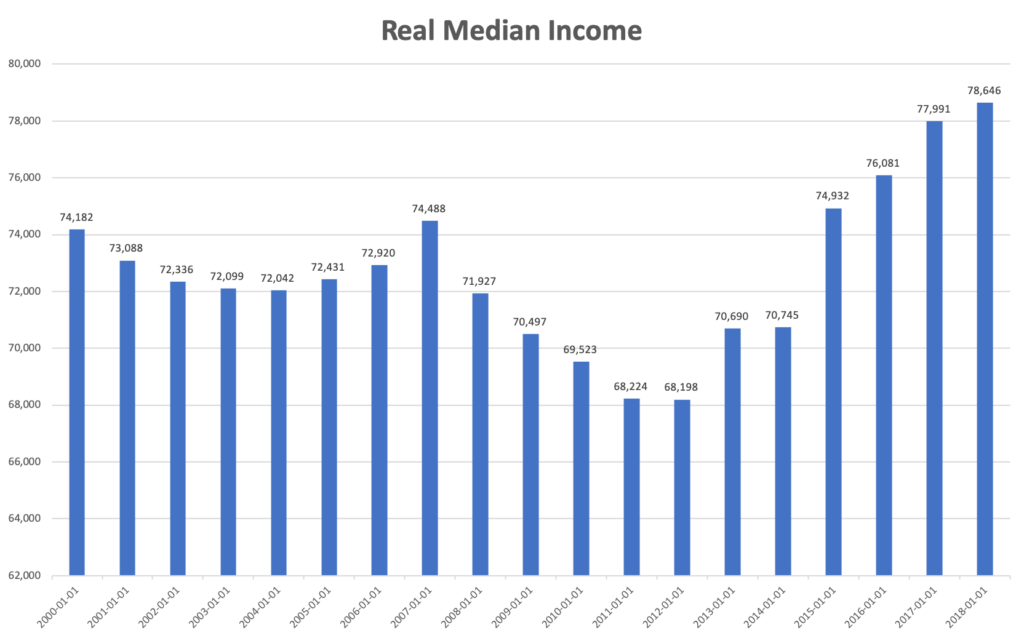

During a recession people will lose their jobs and incomes will shrink. Think back to the great recession of 2008. Between 2008 and 2010 unemployment increased from 4.6% to 9.6%. During the same period median household income decreased by almost 10%. Manufacturing, financial services, construction and entertainment industries tend to be impacted the most during a recession.

How Can I Prepare for Recession?

Think Long-Term

Adopt a long-term perspective. In his 1997 letter to shareholders, Jeff Bezos, CEO of Amazon, issued a manifesto called, “it’s all about the long-term” in which he pledged to plan and make decisions with a long-term lens. This mentality has helped Amazon grow from 11 employees to over 600,000 and become one of the most profitable companies of all time.

Adopting a long-term perspective means taking the time to think 1, 5 and 10 years in the future. What do you want? Where do you want to be? With a clear vision for the future and relentless determination, you can push through short-term hurdles such as recessions and move closer toward your long-term goals.

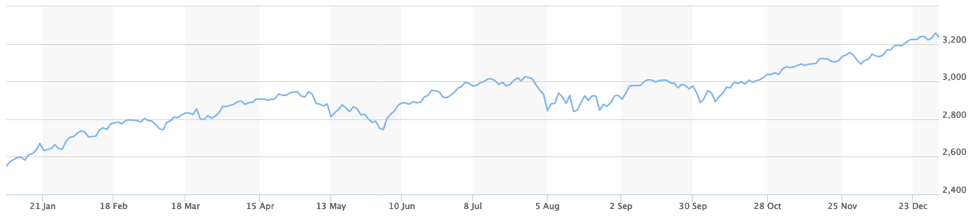

The following chart shows the long-term history of the S&P 500 stock index. With your short-term lens you can clearly see all of the bumps, market corrections and recessions. With your long-term lens you can see long-term growth with a few short-term setbacks.

Adopt a Net Worth Mindset

From the time we are old enough to understand, society conditions us to confuse income with wealth. The most correct long-term measurement of wealth is net worth, Put simple, net worth is the difference between your assets, things you own and your liabilities, debt you own.

Read How to Correctly Measure Financial Success: It’s not How Much you Make, It’s How much You Keep for more information and ideas on how to adopt a net worth mindset.

Maximize Your Professional Value

Increase your value by seeking out additional training and certifications. Take on the hard projects no one wants. Make yourself seem indispensable to your employer. Actively seek to develop relationships and goodwill within your organization. Set some time aside every week to focus on creating new solutions, relationships or even a side hustle. Who knows, these endeavors could save you from layoffs or payoff big financially.

Diversify Your Assets

Diversification is a strategy to decrease the risk of losses by spreading money across investments which have historically moved in opposite directions. The time honored principle of not putting all of your eggs in one basket holds true when preparing for a recession. Spend some time thinking about your risk tolerance. How much are you comfortable losing in the short-term? What are your long-term goals? How far away from retirement are you? Once you know the answers to these questions you can develop a strategy for allocating your assets in cash, stocks, bonds and alternative investments.

There is no one right answer, however, consider the following when developing your diversification strategy:

- Cash, although susceptible to inflation, can be used to buy investments which have decreased in value due to a recession.

- High quality companies with long histories, low debt and healthy cash flows tend to perform better during a recession.

- Stocks are typically must vulnerable to losing value during a recession.

- Alternative investments such as real estate, commodities and even some crowdfunding opportunities may not be influenced by decreases on other asset classes.

- Bonds are generally considered less risky and have historically held up better during a recession.

- Owning too much employer stock can be risky. If your employer falters, you lose both your income and your investment.

Plan to Make Money During a Downturn

Cash, CD’s and Money Market accounts will earn you up to 2% while stock markets are declining. 2% may not seem like a lot but it will feel huge if the stock market drops like it did in 2008.

Buy low and sell high. Adopt a long-term mindset and ride the wave while investing in index funds such as the vanguard S&P 500. If your time horizon is long-enough you will be successfully purchasing shares at a discount to be sold later for a profit.

Do research on other types of assets which do well during an economic downturn. What are some assets that are essential to human survival or for which there will always be demand? A few things to consider:

- Basic human needs such as food and housing will always be needed

- Short and long-term bonds have historically performed well during economic downturns

- Some commodities such as gold outperformed the stock market during the last recession

- Invest in yourself. You are your greatest asset. Education, experience, health decisions, and side hustles are all sound investments to profit from a recession.

Dale