It has been said that debt makes the good times better and the bad times worse. When used properly, debt enables the average American to own a home and a car. When used without restraint, debt can become a crushing financial burden and a long-term drain on hard earned cash.

The psychology of being able to purchases something immediately and pay it off over time is enticing. Before using a credit card to make your next purchase, consider the following.

- Credit card companies charge high interest rates turning most ordinary purchases into difficult to manage financial disasters.

- The average APR on new credit cards is currently sitting at around 17% (creditcards.com). If you have bad credit, the average APR increases to around 25%.

- Credit card companies aim to capitalize on your buy now pay later mentality by using clever advertising to suck you in. We have all heard the phrases, what’s in your wallet, life takes Visa, and Priceless.

- If you were to make only the minimum payment on a credit card balance of $9,333, and assuming you did not take on additional debt, it would take you 89 months to pay off the debt and cost you and additional $7,073 in interest expense. Let that sink in for a minute. It can cost you $7,073 yo borrower $9,333.

- Credit card companies are literally banking on the fact that you won’t do the math and see what a poor financial decision it is to carry a balance on your credit card.

Debt and Credit cards can be used for efficiency and convenience or they can enable unhealthy patterns of reckless spending. The choice is yours.

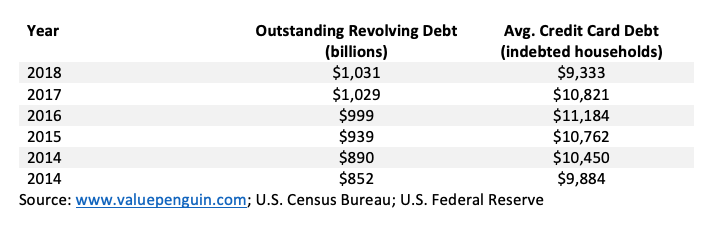

How much credit card debt does the average person have?

As of April 2018 American’s held $1.03 trillion in unsecured revolving debt. That figure breaks out to $9,333 in credit card debt for the average indebted American.

Why do I need to get out of debt?

- Your debt is causing excessive stress, worry, emotional distress, anxiety, and even panic attacks. In a recent survey conducted by Harris on behalf of the American Institute of Certified Public Accountants (AICPA), 68% of millennials, 59% of GenXers and 48% of baby boomers indicated debt as having a negative impact of their everyday life including relationship tension, lies, and excessive worrying at work and at bedtime.

- You are wasting your hard earned money paying excessive interest expense.

- Interest rates are generally determined by your credit score. High debt utilization (balance) leads to a lower credit score which leads to a higher interest rate which leads to a higher debt burden. According to MYFICO.com the average interest rate of a 30-year fixed rate mortgage is 4.249% for a credit score of 760-850. The interest rate increased to 5.838% for a credit sore of 620-639.

- Your debt burden is holding you back from achieving your goals and dreams. Crushing debt can slow or make it impossible to buy a home, start a business and live the life you want.

10 Strategies that Work!

- Assess your financial position. Take a few minutes and list out all your debts including balances owed, monthly payments, and interest rates. Make a separate list of all your assets and determine your net worth. Net worth is the most correct measurement of wealth and the starting point for understanding your financial position.

- Stop creating more debt. It sounds simple right? Before you can reduce debt you must stop spending more each month than you earn.

- Consider going cash only for a period in order to get a better handle on your expenses.

- Implement a waiting period of 2-3 days for major purchases. After the impulse reaction wears off you will better know if it is something you really want or need.

- Cancel, lockup or otherwise hide your credit cards if you lack will power.

- Consider the true cost of your purchases. Think in terms of how many hours you must work in order to pay for your purchase.

- Visualize a debt free You! Ask yourself, how would your life be different without debt? How would I feel? What better opportunities could I provide my family? Make a list of goals and things you want to accomplish and review them frequently.

- Decide on a debt payoff strategy.

- The Psychological Method. This method, sometimes referred to as the debt snowball method aims to boost morale by paying off smallest debts first.

- Order debt balances from lowest to highest.

- After making the minimum payment on all debts, throw every extra penny at the debt with the lowest balance and pay it off first.

- When the debt with the lowest balance is gone, move on the next lowest balance and repeat the process.

- Interest Rate Method. This method, sometimes referred to as the avalanche method provides a structure to help you reduce debt and pay as little interest expense as possible.

- Order your debts by interest rate from highest to lowest.

- After making the minimum payment on all debts, throw every extra penny at the debt with the highest interest rate and pay it off first.

- When the debt with the highest interest rate is gone, move on to the next highest interest rate debt and repeat the process.

- The Psychological Method. This method, sometimes referred to as the debt snowball method aims to boost morale by paying off smallest debts first.

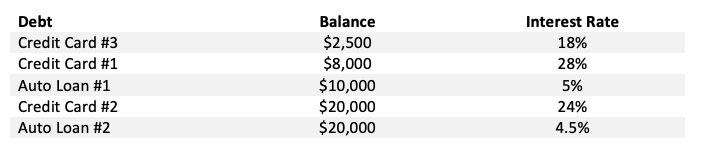

Example 1: The Psychological Method

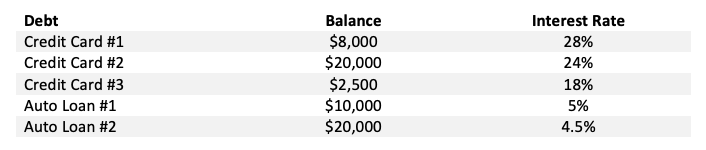

Example 2: The Interest Rate Method

- Make more money. Maximize your professional value by seeking out additional training and certifications. Take on the hard projects no one wants. Actively seek to develop relationships and goodwill within your employment. Set some time aside each week to focus on creating new solutions and relationships. Over time these strategies can lead to increased earning power and ability to pay down debt.

- Sell your stuff. Clean out your garage and or basement. Sell anything with any perceived value on Facebook, Craigslist or other local classifieds platform. You might be surprised how much money you can re-capture from a few hours work.

- Use your tax refund to reduce debt. Resist the urge to buy a new TV this year and instead put that money toward paying off or reducing your debt.

- Negotiate a lower interest rate. In many cases, customers with a good payment history can negotiate a lower interest rate. Spend some time researching competing credit card company offers. Politely contact customer service, remind them what a loyal customer you have been, inform them of the competing offers and ask for a reduced rate. If it does not work out or they refuse to negotiate politely let them know you will be taking your business and money else ware. There are no shortage of credit card companies willing to compete for your debt.

- Do a credit card balance transfer. The concept of a balance transfer is to find a credit card company willing to take on your debt at a lower interest rate. Many credit card companies will offer an introductory rate as low as 0%. Use this introductory period to obtain relief from crushing interest expense and significantly reduce or eliminate the debt. Be sure to do your homework. Some credit card companies can charge excessive balance transfer fees, annual fees and other fees.

- Reduce expenses. Look for ways to reduce your expenses to free up extra cash for paying down debt. Even the little things will add up over time.

- Do you really need subscriptions to Hulu, Netflix, Amazon Prime and Disney Plus?

- Save money by taking your lunch to work and making your own coffee several times a week.

- Evaluate and negotiate lower charges from cell phone, cable, and internet companies.

- Evaluate lower cost auto and homeowners insurance options.

- Drink more water and cutback on coffee, soda, designer drinks that cost more than water.

- Before purchasing, do a quick internet search for coupons or discount codes.

Stay positive. You got this. There is prosperity and happiness ahead if you make a plan and stay the course.

Dale