Imagine for a minute you have arrived. You are successful in your profession and you make a lot of money. Your buying power is substantial. You have the capacity to purchase or make payments on almost anything you want. Are you wealthy? It depends.

It is easy to confuse a good income with wealth. Read the following quote from the authors of The Bogleheads Guide to Investing, a book inspired by the investment advice of John C. Bogle, founder of Vanguard Investments.

“From the time we are old enough to understand, society conditions us to confuse income with wealth. We believe that doctors, CEOs, professional athletes, and movie actors are rich because they earn high incomes. We judge the economic success of our friends, relatives, and colleagues at work by how much money they earn. Six- and seven-figure salaries are regarded as status symbols of wealth. Although there is a definite relationship between income and wealth, they are very separate and distinct economic measures. Income is how much money you earn in a given period of time. If you earn a million in a year and spend it all, you add nothing to your wealth. You’re just living lavishly. Those who focus only on net income as a measure of economic success are ignoring the most important measuring stick of financial independence. It’s not how much you make, it’s how much you keep.”

This advice suggests that there are two approaches to thinking about wealth.

- The income or paycheck mentality.

- The net worth or long-term wealth mentality.

To illustrate the paycheck mentality let’s examine the life of Hollywood star, Nicolas Cage. In the late 1990s Cage was the height of stardom. He had just co-starred with Sean Connery in The Rock and was reportedly bringing in around $20,000,000 a film.

According to his former business manager, Cage would scoff or flat out ignore advice to save or invest money and would regularly squander tens of millions of dollars a year. Cage reportedly purchased 15 homes, a gulf stream jet, four yachts, a small squadron of Roll Royce vehicles, millions in art and of course two castles in England and Germany. Other more unique purchases included shrunken pygmy heads, a Lamborghini, a pet octopus, a deserted island in the Bahamas and a dinosaur skull. Add to that Cage’s entourage and extravagant parties and vacations and you have a recipe for financial disaster.

Eventually Cage hit rock bottom and in 2010 he described his financial situation as “catastrophic.” He was forced to sell his homes in California, Las Vegas, New Orleans, and even his prized Somerset castle, which is built in the shape of the ace of clubs. At one point the IRS filed liens against Cage totaling around $18 million for unpaid state and federal taxes.

The example of Cage is extreme but the principle is clear. Measuring wealth using income alone is short sided and will likely not help you achieve your long-term financial goals, whether they be retirement, financial independence or world domination. The pursuit of wealth most certainly involves earning a high income, but not everyone with a high income is wealthy.

The paycheck mentality is short-term, it is fragile and make you vulnerable by placing all of your financial security on your paycheck. Wealth is long-term, it endures short-term fluctuations. Wealth provides flexibility and has the potential to grow passively.

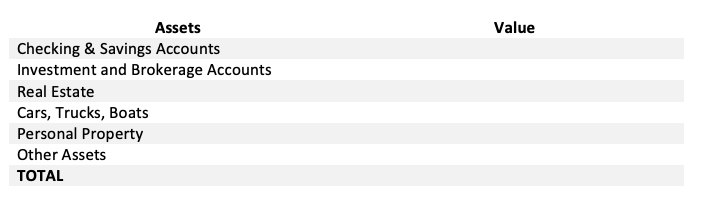

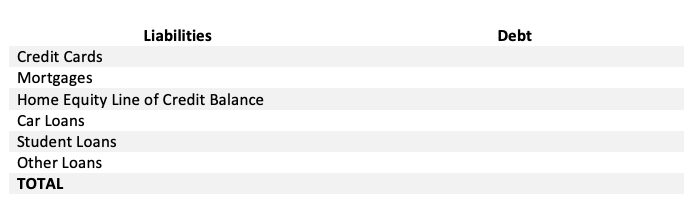

The most correct long-term measurement of wealth is net worth. Put simple, net worth is the difference between your assets, things you own and your liabilities, debt you owe.

Calculate your net worth by adding up the your assets (bank accounts, home, etc.). Next, subtract the total amount of money you own (credit card debt, mortgage, auto loans etc.). What remains is your net worth.

Use the following charts to calculate your net worth.

Total Assets – Total Liabilities = Net Worth. Start the habit of calculating your net worth at least twice a year.

Dale