Learn the three simple rules for using credit cards. Your credit card is a tool for purchasing convenience not a loan.

During my time as a consumer advocate, I spoke daily with people struggling to get out from under credit card debt. While some people genuinely had fallen on hard times, most people I spoke with openly admitted to using poor judgment and attributed mistakes to lack of education. This is no surprise given only 21 states require a personal finance course to graduate high school.

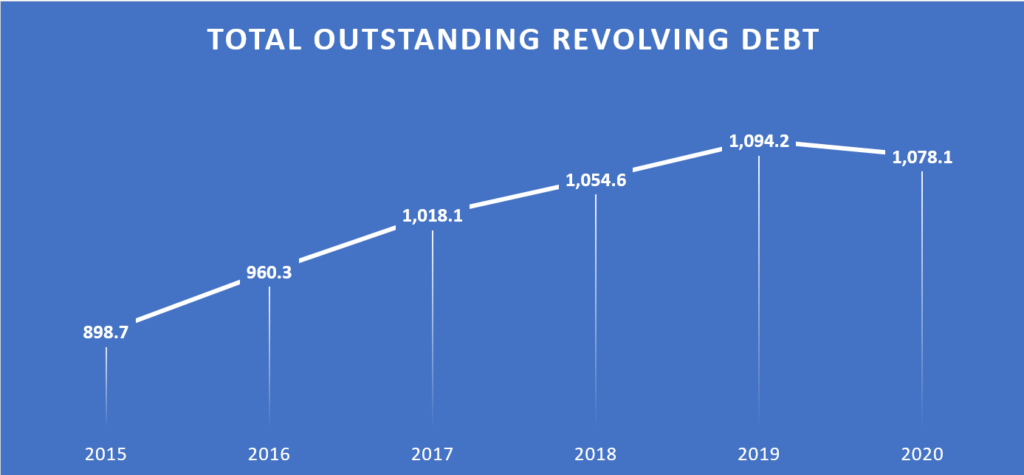

The psychology of being able to purchase something immediately and pay it off over time can be enticing and profitable for credit card companies. Credit cards are big business. Credit card debt in America has been steadily increasing leading up to the 2020 pandemic. As of January 2020 total credit card debt in America was sitting at $1.1 trillion dollars.

Clever advertising, travel perks and cash back rewards have lured many into a cycle of credit card abuse and hopelessness. As I write, I can hear the voice of Samuel L Jackson, spokesman for Capital One asking “What’s in your wallet?”

Credit card companies are literally banking on the fact you cannot do simple math. Assume you finance a $5,000 purchase using your credit card and plan to make only the minimum monthly payment of around $100. It will take you 93 months to payoff $5,000 and you will end update paying $4,299 in interest for a grand total of $9,299.[i]

Credit Card Basics

Credit cards are tools issued, by banks or finance companies, which allow you to make purchases on credit with the promise to repay the amount plus interest. These purchases are typically unsecured, meaning you do not have to pledge collateral to use a credit card.

Credit cards are higher risk which is why credit card companies charge higher interest rates. The average credit card interest rate is 17%. If your credit history is less than perfect, you could end up paying over 25% interest.

Three Simple Rules for Using Credit Cards

Using and understanding credit cards does not need to be complex or stressful. Keep to the following rules and you will be fine.

- Only use your credit card if you have the same amount of cash in the bank and are planning to pay off the balance at the end of the month.

- Never make only the minimum payment. If you absolutely must make a credit card purchase that cannot be paid off at the end of the month, do the math and understand what you are getting into. Plan for paying off the credit card and stick to the plan.

- Get something back. Only use credit cards with cash back rewards, meaning you will receive a portion of your purchase back in the form of cash or other rewards.

[i] Assumes average interest rate of 17.98%. Minimum monthly payment requirements vary by credit card company but generally ranges from between 1% and 3% of balance. $100 is 2% of $5,000.